Data Analytics Market to Reach $190 Billion in 2028

The exponential growth of data, driven by IoT, cloud computing, and AI advancements, is transforming how businesses operate and make decisions, according to GlobalData.

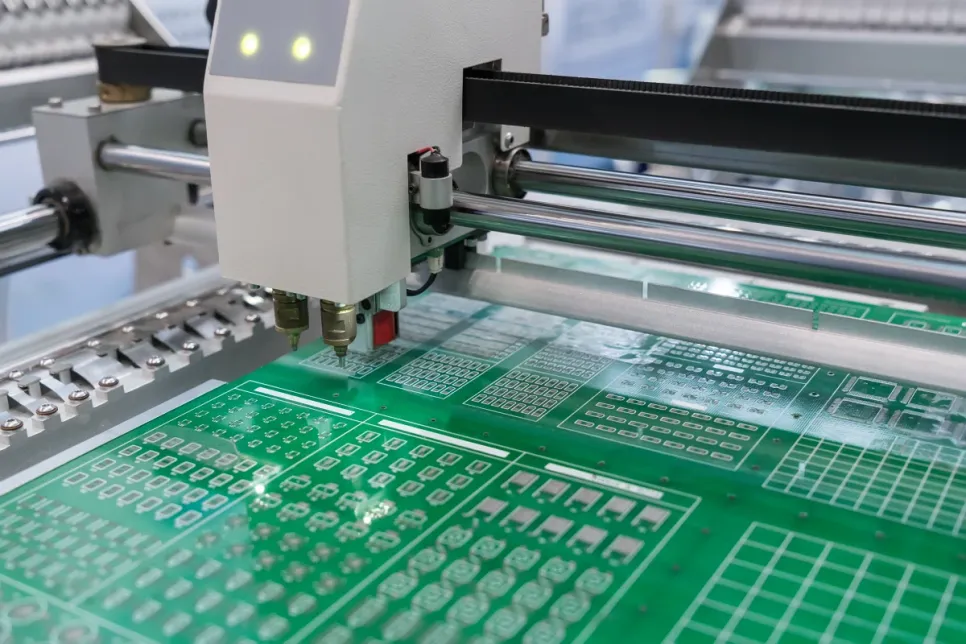

The global semiconductor market surged in 3Q24, with revenues climbing 8.5% from the previous quarter to $177.8 billion, according to Omdia. The growth was driven by the booming AI segment.

This demonstrates a remarkable 25% year-over-year growth from $141.6 billion in 3Q23, positioning the industry for an impressive 24% annual expansion. Aggregate semiconductor revenue for the first three quarters of 2024 increased by 26% compared to the same period in 2023, a $102 billion increase. This growth was fueled by strong demand for AI and related semiconductor components.

“The high demand for AI is setting 2024 up to be a record-breaking year. Semiconductor revenue from the first three quarters of 2024, approximately $494 billion, has already surpassed the total for all of 2020. However, this robust revenue is not evenly distributed across the industry. For example, the industrial sector is facing weak demand and is projected to see a 16% year-over-year decline in 2024,” said Cliff Leimbach, Senior Analyst at Omdia.

NVIDIA and SK Hynix are two companies that have greatly benefited from the AI surge: NVIDIA through its GPUs, and SK Hynix through high-bandwidth memory. Among the 127 semiconductor companies analyzed in the Competitive Landscaping Tool report, these two companies are the only ones who have more than doubled revenue in the first three quarters of 2024 compared to the same period in 2023.

Semiconductor revenue is expected to continue growing in the fourth quarter, increasing approximately 4.5% to nearly $186 billion, as AI-focused companies continue to outperform the broader semiconductor industry. However, growth outside of AI has been challenging in certain sectors. The automotive market, saw consistent semiconductor revenue growth has stabilized as demand leveled off in 2024, with revenue expected to remain flat compared to 2023. Additionally, weak macroeconomic conditions have impacted the industrial segment, which is forecasted to experience a $10 billion decline in revenue in 2024 compared to 2023.

Despite the uneven performance across semiconductor segments, all top ten companies saw sequential revenue growth with 17 of the top twenty companies also growing quarter-over-quarter. NVIDIA held the number one ranking in the third quarter, with a 10.5% revenue increase from Q2 driven by AI demand. Its share of the semiconductor market rose slightly to over 15%. Outside of NVIDIA, improved memory market dynamics have boosted memory companies' rankings. The memory market is forecast to grow by $73 billion in 2024 than 2023 placing Samsung, SK Hynix, and Micron in the top six.